Your PARTNER to CHINA : invest China, business China, consulting China, investment China, internationalization SME China

Vehicles to invest in China

Foreign investors have several instruments for establishing in China.

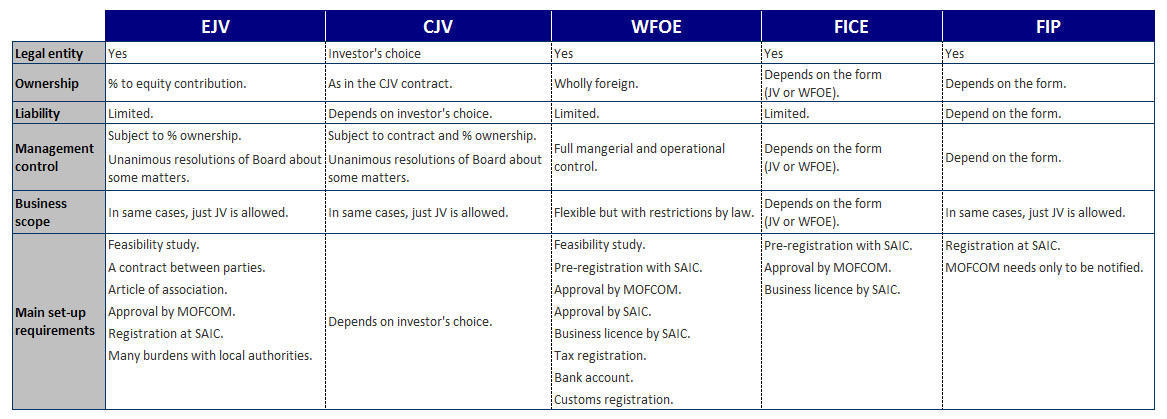

Foreign investors have several instruments for establishing in China. First of all, they must choose between entering the Chinese market by setting up an enterprise or through other forms of establishment; then, they must choose whether to have a Chinese partner or not. If they choose the first solution, the following corporate vehicles are available: joint venture (JV), wholly foreign-owned enterprise (WFOE) and foreign-invested commercial enterprise (FICE). If they choose the second one, they can establish a representative office (RO). Each structure has its own specific legal implications, as briefly underlined below. A joint venture is a limited liability legal entity that should represent a good solution for investor who wants to benefit from existing facilities, workforce and exiting sales’ distribution channels, when Chinese Government restrictions require a local partner. A JV can be in two forms: Equity JV (EJV), which provides for equity participation of foreign partners and local, or Cooperative JV (CJV), that is a flexible agreement collaboration between foreign and local partners. It can give rise to a company (with partners’ responsibility and profits’ distribution limited to share) or be a cooperation agreement (with unlimited partners’ responsibility). In the absence of specific laws, practice sets the minimum share capital to approximately RMB 1,000,000. However, the law establishes a ratio of total investment and registered capital. Members can contribute with technology, machinery and buildings, as well as currency. The parties may choose to pay the capital in a lump, within 6 months after registration or to pay in different solutions. In this case, however, the partners have the obligation to pay at least 15% of the shares within 90 days of the issuance of the business license. Members must pay all the capital in a period of between one and three years from the date of issue of the Business Licence, based on the amount of registered capital. The establishment of an EJV requires, among others, a contract between the parties, an article of association, the approval of MOFCOM and SAIC registration. Preparing these documents may be quite long, so the practice is to conclude a letter of intent between the parties, setting times and ways to implement the project. From the moment the company gets the Business Licence, the directors are required to meet many different burdens with local authorities. A big issue of this form could be partners’ reliability. A wholly foreign-owned enterprise is a limited liability legal entity, with an industry specific minimum capital investment. In some sectors is not allowed foreign companies to invest in form of WFOE, so before deciding it should be check the Catalogue for the Guidance of Foreign Investment Industries, which lists the industrial sectors where foreign investment is encouraged, restricted or prohibited. In some cases, investment is allowed only in the form of JV. WFOE is flexible in business scope, permits 100% ownership and control by foreigners and allows to convert RMB in foreign currency for profit repatriation. A WFOE can take two main forms: Limited Liability Company (responding to social obligations only with its capital) and One-Person Limited Liability Company (with only one member). The limit for registered capital is 30,000 RMB for a Limited Liability Company WFOE and 100,000 RMB for One-Person Limited Liability Company WFOE, for all sectors. The law establishes a ratio of total investment and registered capital. To set up a WFOE many steps are required; main of these ones are: name pre-registration with SAIC, approval by MOFCOM, approval of Article of Association and Issue of approval certificate by SAIC, issue of business licence by SAIC, tax registration, bank account opening, customs registration. The complete procedure usually needs 3-4 months from commencement to license issuance, depending on industries. Investors tend to prefer WFOE to avoid difficulties and potential conflicts related to the presence of a local partner as in JV. A foreign-invested commercial enterprise is an independent and limited liability legal entity, with a minimum capital investment of US$ 4,420. It is a good solution for foreign investors that want to import and export goods, buy and sell goods, trade or offer consulting services. FICE can be formed either as joint venture and as WFOE, by foreign companies, corporations or other economic organizations and individuals operating in China. It is required capital in line with the provisions of the Company Law: 100,000 RMB for wholesale and retail enterprises; it can therefore be required an higher capitalization depending on kind of business. Main steps to set up a FICE, similar to WFOE’s set up ones, are the following: name pre-registration with SAIC, approval by MOFCOM, issue of business licence by SAIC. The complete procedure usually needs 3-4 months from commencement to license issuance. FICE permits to remit profit back to overseas. A representative office, at the end, has no legal personality but it is inexpensive to set up, so it should be a good solution “to explore the market” by foreign investors. Its registration become more difficult with the issuance of New regulations about in 2009. For further details on this form, please refer to news’ section.

Services

Our extensive network allows us to give a full set of consulting services to invest in China. We provide assistance for the internationalization of the SME in China for:

About Us

Our consulting company supports every business phase for client who want to invest in China, thanks to our professional people and extensive Chinese network, also called "Guanxi". It allows the company (SME in particular) to minimize risks and disappointments when doing business in China.